Checking Account

A checking account usually serves as the safest and

the easiest way for you to keep track of your money. A

checking account is a financial arrangement with a

bank, savings and loan association, or credit union for

safeguarding money. It provides a system that allows

you to account for your money—both what you’ve

received and what you’ve spent. Money you receive

might be your paycheck, while money you expend

might be a bill you pay.

Some terms that deal with checking accounts are

shown below.

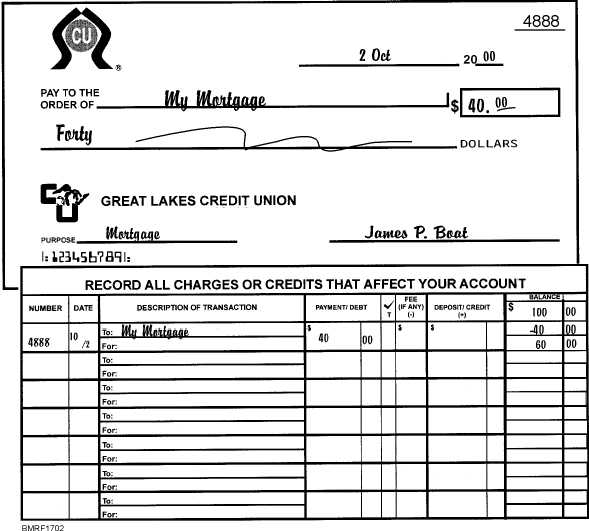

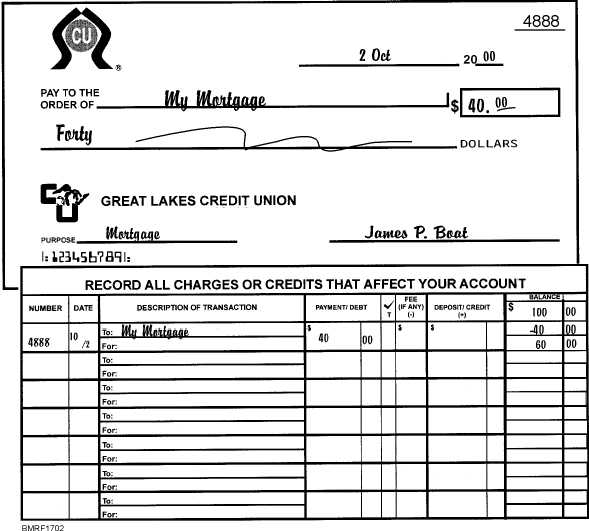

Check. A check (fig. 17-2) is a written order telling your

bank to withdraw a sum of money from your

account to pay another person or business.

Check register. A check register is a booklet used to

record transactions involving your checking

account.

Deposit ticket or deposit slip. A deposit ticket (fig. 17-3)

is a slip of paper used to place money into your

account. Deposits can be done either electronically

or by you actually going to the bank, filling out a

deposit ticket, and handing it to a teller.

17-7

Student Notes:

Figure 17-2.—A check and check register.